Why Ethiopian Bitcoin Mining is Smart Economics – Turning Surplus Power into Digital Gold.

“By Joseph Nganga, CEO, Africa Climate & Energy Nexus (AfCEN).”

Imagine a bakery that bakes more bread than it can sell by day’s end. Rather than tossing the unsold loaves, it offers them at a discount to latecomers – converting potential waste into extra cash. Ethiopia is doing something similar on a grand scale with its electricity. By harnessing surplus renewable power that would otherwise go unused, Ethiopia is earning hard currency through Bitcoin mining. This bold, climate-smart strategy is turning idle megawatts into digital assets, much like selling day-old pastries before they go stale. And while some critics worry it diverts energy from citizens, in truth it’s leveraging power that isn’t reaching those citizens in the first place – akin to an Uber driver offering cheaper rides during off-peak hours to make use of an idle car. Far from depriving anyone, Ethiopia’s approach monetizes unused energy for the good of the nation.

A Smart Use of Surplus Energy

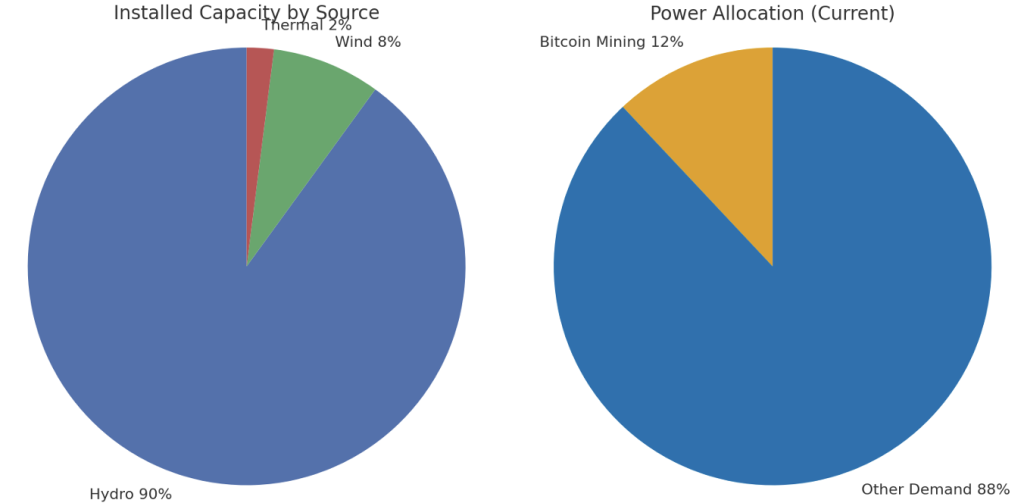

Ethiopia’s power sector is blessed with abundant renewables. The country has about 5,200 MW of installed generation capacity, of which ~90% is hydropower (from rivers like the Nile), about 8% is wind, and only 2% thermal[1]. In other words, Ethiopia is nearly a 100% green grid. Yet much of this capacity isn’t fully utilized – partly because electricity access is still limited (only ~55% of Ethiopians have grid access[2]) and transmission lines don’t yet reach all communities. This leads to stranded power in certain regions (for example, around large dams) that cannot be consumed locally or delivered to distant cities due to infrastructure gaps. Rather than let that clean energy go to waste (or spill over dam walls), Ethiopia has invited Bitcoin miners to put it to use.

Today, approximately 600 MW – around 12% of Ethiopia’s capacity – is allocated to Bitcoin mining farms[3]. These mining data centers are intentionally sited near sources of surplus generation, where local demand is low and transmission bottlenecks prevent exporting the power. By acting as “energy sinks,” the miners soak up excess electricity that would otherwise be idle. Importantly, they run on the excess – not the power needed by homes or industries. It’s similar to how rideshare prices drop when demand is low: a miner is like a passenger always willing to take the ride during those off-peak hours, ensuring the energy isn’t wasted. The Grand Ethiopian Renaissance Dam (GERD), for instance, is now Africa’s largest hydro project (planned 6,450 MW) and already produces more power than the grid can absorb at times[4][5]. Bitcoin mining offers a flexible demand to match this supply. If done right, this “use it or lose it” energy monetization actually stabilizes the grid and encourages further investment in generation, since there’s a buyer for electricity even in remote areas or low-demand periods[6]. Ethiopia plans to nearly triple capacity to 17,000 MW in the next decade[7] – a goal that becomes more attainable when surplus power can be turned into profits that fund expansion.

Figure: Ethiopia’s electricity generation mix is dominated by renewables (left), and currently ~12% of its installed capacity is used by Bitcoin mining (right). Hydropower (blue) forms the bulk of 5,200 MW generation[1], and mining only taps into underutilized capacity (orange slice) without displacing other consumers.

Far from draining national energy, Bitcoin mining in Ethiopia is leveraging the country’s excess capacity to create value. These operations do not compete with households or hospitals for power – they are located where power is available but demand is not[8][6]. In fact, by providing revenue that can fund new power lines and substations, the presence of miners can accelerate electrification for underserved areas. It’s a virtuous cycle: surplus energy fuels mining, mining generates revenue, and revenue finances grid extension. Ethiopia is essentially doing what any smart business would – monetizing an oversupply at a discount, then reinvesting the earnings to grow the core market.

Powering the Economy with Digital Dollars

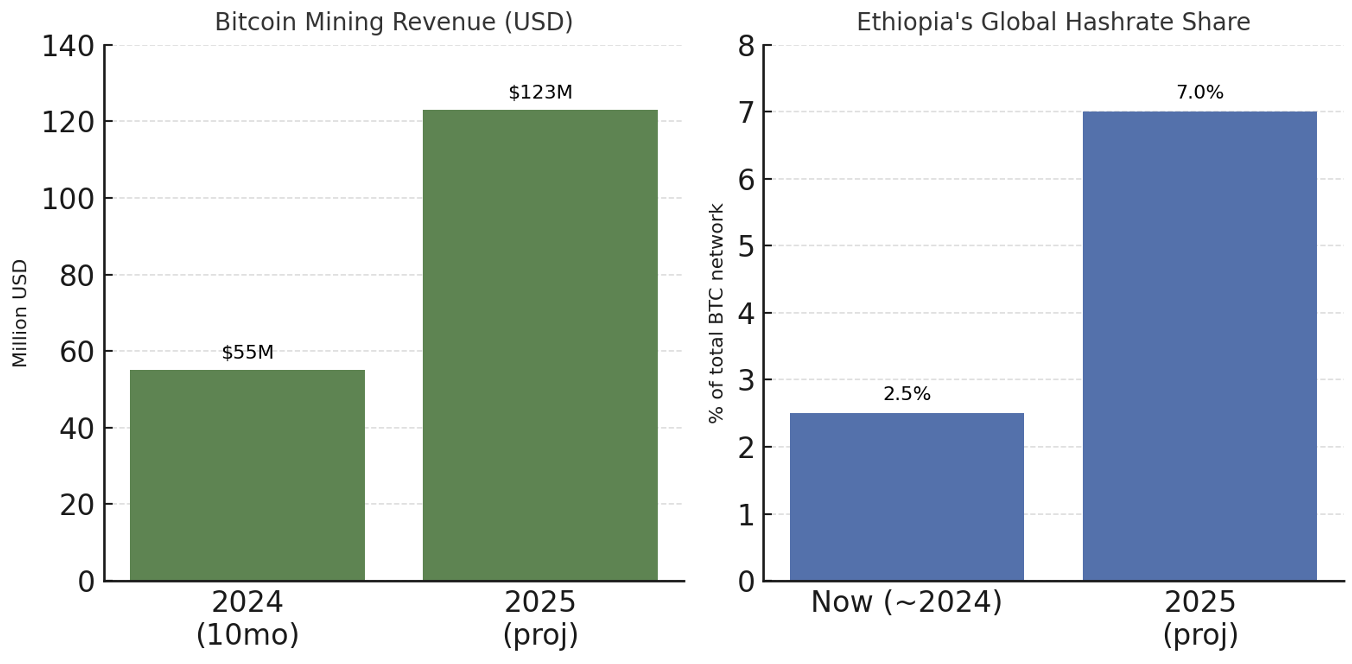

Crucially, Ethiopia’s bitcoin mining sector isn’t just about earning cryptocurrency – it’s about earning real currency. Mining companies pay hard USD for the electricity they use, injecting much-needed foreign exchange into Ethiopia’s economy[9]. In a country that has struggled with forex shortages and even defaulted on a $33 million Eurobond payment in 2023[10], these dollar inflows are a lifeline. Ethiopian Electric Power (EEP), the state utility, reportedly earned $55 million from Bitcoin mining in just 10 months, accounting for roughly 18% of its annual electricity revenue[11]. By comparison, exporting power to neighbors like Kenya and Djibouti brought in only about $30.8 million in the same period[12]. In other words, selling excess electricity to Bitcoin miners has proven far more lucrative than selling it abroad at bargain rates.

And the scale is growing. Global mining firms have taken notice of Ethiopia’s ultra-low power costs (≈ \$0.03 per kWh)[13] and renewable bounty. Reputable players like China’s BIT Mining and Bitmain-backed BitFuFu have set up operations, signing deals with EEP[14][15]. EEP has inked power purchase agreements with over 25 mining companies as of late 2024[15]. As a result, Ethiopia’s mining power demand could reach 1,000 MW by 2025 – nearly double current usage – which would amount to an estimated 7% of the entire Bitcoin network’s hashrate[3]. For context, that would place Ethiopia among the top 5 Bitcoin mining nations globally, alongside the U.S. and China[16]. The foreign investment accompanying these projects (for data centers, hardware, and jobs) also brings technology transfer and skills into the country[17].

Financially, the trajectory is impressive. EEP’s revenue from mining is projected to hit $123 million by 2025[9] – over twice what it earned in the initial period. These digital dollars don’t sit idle; they go straight into Ethiopia’s economy. The government can use the forex to import essential goods (medicine, machinery, fertilizer) and to stabilize the Ethiopian birr. It reduces reliance on volatile aid or debt. In short, this is economics, not speculation – converting renewable energy into a steady stream of hard currency. Analysts estimate that integrating Bitcoin mining at this scale could contribute $2–4 billion to Ethiopia’s GDP in the coming years[18] – a substantial boost for a $100+ billion economy – by energizing ancillary industries and improving the balance of payments. Ultimately, these revenues bolster macroeconomic stability, build fiscal confidence, and even help attract foreign investors to other sectors (seeing a government willing to innovate for growth)[9][19].

Figure: Bitcoin mining is already delivering economic benefits. Left: EEP’s revenue from selling surplus power to miners was about $55 million in 2024 and is projected to reach $123 million in 2025[9]. This brings critical USD inflows into Ethiopia’s economy. Right: Ethiopia now contributes roughly 2.5% of global Bitcoin mining power, a share that could grow to 7% by 2025 as capacity expands[3]. In the global Bitcoin network, Ethiopia has quickly become a notable player.

Reinforcing the Grid and Funding Development

Perhaps the most profound impact of Ethiopia’s mining strategy is what it enables on the ground: infrastructure development. The government isn’t treating Bitcoin mining as a short-term cash grab; it’s channeling the earnings into long-term assets. Mining revenue is being reinvested in expanding the electrical grid – building transmission lines, substations, and distribution networks[20][21]. This directly supports Ethiopia’s ambitious National Electrification Program, which aims to achieve near-universal access in coming years[20]. In effect, Bitcoin is helping lights come on in villages that were literally in the dark. Every dollar earned from mining is a dollar that can finance poles and wires to connect a new community. This approach turns a potential waste stream (unused power) into a financing engine for development, creating a positive feedback loop: surplus energy → mining revenue → grid extension → more customers → justified expansion of generation.

Concrete examples are already visible. Ethiopia’s flagship hydro projects like GERD and Koysha (2,160 MW) often produce more power than can be immediately absorbed locally[22][23]. Mining provides a way to monetize that excess capacity right now, so that funds are available to extend transmission lines from these dams to far-flung areas[23][24]. It essentially brings the market to the energy source instead of waiting to bring the energy to the market. Analysts and industry experts see this as a game-changer for financing infrastructure in a capital-constrained economy: Bitcoin mining is like an instant buyer for new generation projects, improving their economics. By some estimates, the mining sector’s growth could add on the order of $2–4 billion to GDP, much of that in the form of infrastructure and jobs, providing a “bank” of capital that Ethiopia would otherwise struggle to access[18]. Notably, this model has begun to inspire other African countries facing similar dilemmas of energy oversupply in one region and energy poverty in another – a point we revisit later[25].

Socially, the reinvestment of mining proceeds means millions of Ethiopians stand to gain electricity for the first time as the grid grows[21]. It’s a direct rebuttal to the criticism that “Bitcoin mining steals power from the poor.” On the contrary, it is funding power for the poor. One can draw an analogy to a water utility: if there’s a surplus of water in one area that can’t be piped to those who need it, selling that water to a factory provides money to build new pipes for everyone. Ethiopia is doing exactly that with electrons – selling surplus to build the wires that will deliver future power access more broadly. It’s energy monetization with purpose, converting kilowatts into kilometers of power lines.

Elevating Ethiopia’s Digital Footprint

There’s another often overlooked benefit to Ethiopia’s mining push: it is jumpstarting the country’s digital infrastructure. Running large-scale Bitcoin mines involves deploying data centers filled with high-performance computing (HPC) equipment. The investment in these facilities – from robust power systems and cooling to fiber connectivity – lays the groundwork for broader tech and IT services in Ethiopia[26][27]. In effect, the country is piggybacking on the mining boom to build its own digital capacity. Today it’s Bitcoin mining; tomorrow the same infrastructure could support cloud computing, artificial intelligence research, or big-data analytics[28][29]. The expertise gained in managing 24/7 data centers and the workforce trained to maintain thousands of servers are exactly what’s needed to propel a modern digital economy. What skeptics dismiss as “mining crypto” is in Ethiopia being translated into strategic capacity-building for the future.

Already, we see signs of this evolving vision. Ethiopia’s government has struck partnerships to integrate mining with broader tech initiatives – for example, a $250 million joint project with West Data Center Group to establish a facility that combines Bitcoin mining and AI data center capabilities[30][31]. This kind of project shows the long-term thinking at play: the mining rigs generate revenue while they operate, and the data center infrastructure can later be repurposed or concurrently used for cloud services and AI computations. Ethiopia is effectively leapfrogging into the digital era, using Bitcoin as a stepping stone. With roughly 2.5% of the global Bitcoin hashrate now coming from Ethiopia[32], the country has put itself on the map as a global tech player. Achieving the projected 7% share by 2025 would make Ethiopia a true heavyweight in the Bitcoin network[3] – a remarkable feat for a nation that until recently wasn’t even mentioned in conversations about high-tech industries.

It’s worth noting that much of the initial mining investment has come from abroad – companies from China (which comprise an estimated 80% of the mining presence), as well as some from Europe and the U.S.[17]. While foreign capital funded the hardware, Ethiopia has kept sovereign control over its energy assets and made sure the arrangement benefits the country directly. The mining agreements are structured through licenses and power contracts with EEP[15], ensuring the activity operates on Ethiopia’s terms. And as operations ramp up, there is growing room for Ethiopian entrepreneurs and firms to participate – whether in providing support services, maintenance, or even launching local mining ventures. The government’s openness to innovative energy monetization has sent a signal to the tech community: Ethiopia is crypto-friendly (at least for mining) and open to business. Home-grown startups can build on this foundation, perhaps exploring related opportunities in blockchain and fintech. Indeed, forward-looking platforms like AfCEN (Africa Climate & Energy Nexus) are already exploring cutting-edge models such as tokenization of real-world infrastructure assets – for instance, issuing digital tokens linked to renewable energy plants, data centers, or mining farms. Such ideas, though nascent, point to an exciting future where clean energy projects in Africa could be financed through crypto markets, enabling global investors to directly back African infrastructure. This blend of renewable energy and digital finance is precisely the nexus that AfCEN and others are keen to develop, positioning Africa as a leader in innovative climate-tech finance.

Responsible, Renewable, and Forward-Looking

No discussion of Bitcoin mining is complete without addressing the environmental question. Globally, cryptocurrency mining has a dirty reputation – often associated with coal-burning power plants or excessive carbon emissions. Ethiopia decisively breaks that mold. Its mining operations are powered almost entirely by renewable energy, chiefly the massive hydroelectric output of GERD, supplemented by wind farms[33][34]. There are virtually zero fossil fuels in Ethiopia’s mining electricity mix, which makes it one of the greenest crypto mining endeavors in the world[33][35]. By transforming surplus clean energy into economic value, Ethiopia is proving that Bitcoin mining can be compatible with climate goals[36]. In fact, as Ethiopia prepares to host the Africa Climate Summit 2, the country can showcase an example of leveraging renewables in an innovative way to drive development. The carbon footprint of Ethiopia’s mining is negligible (the power would be generated at the dam regardless; using it for mining adds no extra emissions)[36]. This is a powerful rebuttal to the argument that crypto is inherently bad for the planet – here, crypto is funding climate-resilient infrastructure without any smoke stacks.

Beyond the environmental aspect, Ethiopia’s approach has been strategic and sovereign-minded. By permitting mining under a regulated framework, the government has attracted foreign investment while retaining control over critical infrastructure (the dams and grid remain national assets)[15][37]. The country directly benefits through the revenues and improved grid assets, rather than, say, a foreign entity simply exploiting local resources. And there’s a significant element of technology and knowledge transfer: international mining firms have brought in modern data center practices, electrical equipment, and specialist training for local technicians[17]. Ethiopian engineers and developers are gaining experience in a cutting-edge industry. Over time, this builds local capacity for managing not just mining rigs, but any high-performance computing ventures. Jobs are being created – from construction crews building out power infrastructure, to electricians, to IT specialists – planting seeds for a broader digital economy. This ecosystem is evolving rapidly. What might have started as a few pilot mining sites has grown into an entire cryptocurrency mining ecosystem, with local support services and the potential for home-grown mining initiatives.

That said, no innovation comes without challenges. A legitimate concern in Ethiopia’s case lies in the regulatory landscape and ensuring the benefits are broadly shared. As of now, Ethiopia has a curious policy mix: crypto mining is allowed under special licenses (often categorized as “high-performance computing” centers), but cryptocurrency trading and usage remain banned for citizens[38]. This one-sided approach – where the country welcomes miners to earn Bitcoin but prohibits its circulation domestically – can create uncertainty. Investors crave clarity; local entrepreneurs, too, would benefit from knowing the rules won’t change abruptly. Moreover, ad-hoc adjustments (for example, sudden tariff changes or moratoria on new mining licenses) could undermine trust in Ethiopia’s commitment to the sector[38]. The government appears aware of this and is reportedly drafting more comprehensive regulations for digital assets[39]. To fully harness crypto mining as an economic lever without causing instability or inequity, Ethiopia will need a predictable, inclusive, and forward-looking regulatory framework. That means clearly defining what activities are permitted (mining, custody, perhaps future crypto services) and what remain restricted, streamlining licensing procedures so legitimate investors can set up easily, and harmonizing oversight across different agencies (energy, finance, ICT) so that the left hand and right hand of government are coordinated. Engaging stakeholders – mining firms, community representatives, financial experts – in dialogue as policy evolves will also be key to striking the right balance.

In time, Ethiopia might cautiously explore expanding crypto use cases in a way that complements its development goals. One idea floated by local analysts is to pilot remittance applications using crypto – Ethiopia has a large diaspora, and crypto could potentially offer cheaper, faster money transfers if regulated properly. Another idea is tokenizing investments in energy projects (which, as noted, AfCEN and others are examining) to raise capital for solar, wind, or grid upgrades by issuing digital tokens to investors. These would be logical extensions of the current experiment, if done in a sandboxed, well-regulated manner. The government’s priority, however, will rightly be to ensure the core mining operations continue smoothly and benefit the broader public. Measures like taxes or royalty fees on mining profits, and mandates for reinvesting a portion of earnings locally (for example, in community development funds) could help maximize the social return[40][41]. Essentially, Ethiopia can aim to be not just a low-cost destination for miners, but a responsible, collaborative partner that insists on win-win outcomes (profit for the companies and progress for the nation).

From Power to Prosperity

When Ethiopia built the GERD mega-dam, the vision was never just about generating electricity – it was about sovereignty, development, and self-reliance. The dam was a nation’s wager on itself, a monumental project to secure energy independence and lift millions out of poverty. Now, Bitcoin mining is offering a direct path to realize that vision. Rather than let excess power sit idle, Ethiopia is using it to build wealth at home and empower its people. The strategy flips the narrative of resource exploitation on its head: this is not a foreign oil company extracting value; it’s Ethiopia minting value from its own renewable resources.

As the Africa Climate Summit 2 approaches, it’s inevitable someone will ask: “Should Ethiopia really be mining Bitcoin when millions of its citizens still lack electricity?” It’s a fair question rooted in genuine concern. But the answer, upon examining the facts, is a resounding yes – because this mining is precisely what will help bring electricity to those millions. The choice isn’t between Bitcoin and light bulbs; it’s between wasting the energy we have vs. harnessing it to fund a brighter future. And Ethiopia has chosen the latter. The numbers bear it out: 600 MW of otherwise-unused power now monetized, \$55+ million earned and reinvested, projects underway to expand access[9]. The logic is sound: you can’t deliver power to people with incomplete grid infrastructure, but you can use stranded power to earn revenue, which pays for completing that infrastructure. Each bitcoin mined is effectively paying for poles and wires to connect families to the grid. And the long-term vision is clear: a self-financed expansion of electricity access and digital infrastructure, breaking the cycle of dependency on external aid or loans. In short, Bitcoin mining in Ethiopia does not take power away from anyone – it funds the very projects that will deliver power to those who need it most. It’s a bridge from present surplus to future scarcity reduction.

This is not techno-utopian speculation. This is strategy. Ethiopia is leveraging an innovative tool to address an age-old development challenge. It’s a pragmatic solution born of necessity and ingenuity – turning a problem (excess untapped energy) into an opportunity (economic and social gains). Much like the bakery that sells leftover bread to invest in a bigger oven, Ethiopia is selling surplus electrons to invest in a bigger, better grid. The country has essentially said: If Bitcoin mining can help us electrify rural Ethiopia, stabilize our economy, and train our workforce, then why not use it? That is a sovereign decision to bet on oneself.

Africa’s Blueprint for Energy Sovereignty

Zooming out, Ethiopia’s experiment should be viewed as a blueprint for Africa-wide energy sovereignty and digital development. Across the continent, many nations grapple with a similar paradox: abundant renewable energy potential (from rivers, sun, wind, geothermal) alongside energy poverty and financing shortfalls. Ethiopia has demonstrated a model where you monetize excess green energy through innovation, attract global investment on your own terms, and reinvest the gains to fortify both the energy infrastructure and the digital economy[42]. It’s a path to breaking out of the traditional constraints that have slowed African development. Instead of waiting decades for demand to organically grow into supply (or for donors to fund every transmission line), countries can accelerate the timeline by turning their stranded power into a revenue-generating asset today.

Other African nations are taking note. For example, Nigeria – with its vast gas flaring waste and untapped hydro – is exploring Bitcoin mining as a way to utilize energy that would otherwise be lost, with analysts suggesting it could follow Ethiopia’s lead soon[25]. Kenya and Zambia are piloting schemes where small renewable installations power both rural communities and Bitcoin miners, ensuring the economic viability of mini-grids[43]. And in the Congo, Virunga National Park has famously used micro-hydro-powered Bitcoin mining to fund wildlife conservation when tourism revenue fell[44]. These examples underscore a fundamental shift: Bitcoin mining can be a catalyst for renewable energy deployment and a backstop for grid stability – a far cry from the idea that it’s just a frivolous energy drain. What Ethiopia offers is the first national-scale validation of this concept.

Of course, each country will have its own circumstances and must tailor the model to its needs. But the core idea – energy sovereignty through digital assets – holds tremendous promise. By converting kilowatts to kilobytes (of blockchain proof-of-work), nations can generate new streams of income that are independent of commodity price swings or geopolitical whims. It’s like creating a sovereign digital export out of electrons and innovation. For Africa, this could mean greater resilience and self-determination: funding climate-resilient infrastructure without begging for grants, developing tech skills without waiting for multinationals to outsource, and keeping more value within national borders.

Ethiopia’s early success should encourage international development partners and African policymakers to give this approach a serious look. It may well be a replicable roadmap for marrying the twin goals of energy access and digital transformation. Yes, prudent governance is required – the risks (regulatory, social, environmental) need managing – but the Ethiopia case shows those risks can be mitigated and the rewards are tangible. Bitcoin mining is not a gamble for Ethiopia; it’s a calculated investment in the nation’s future[45]. It’s the country betting on itself and, so far, yielding results. As Africa strives for climate-smart growth and energy equity, let’s recognize what Ethiopia has achieved for what it truly is: a strategic leap forward for African energy economics and tech-enabled development[19]. In the annals of innovative policy, this could stand out as the moment an African nation turned a global technological trend into a homegrown solution for prosperity – a moment of digital empowerment and energy sovereignty that others can follow.

In the end, the lights turning on across Ethiopia’s villages in the coming years may owe a small debt to the whirring sound of Bitcoin miners. And that is a story of ingenuity worth celebrating – and replicating – across the continent.

Sources: The facts and figures in this article are supported by reports from industry news and research. Key references include Ethiopia’s installed capacity and renewable mix[1], official plans for grid expansion[7], crypto industry analyses of Ethiopia’s mining revenue and global hashrate share[46][47], and commentary on the development impacts[48][18], among others as cited throughout. These illustrate the evidence behind Ethiopia’s energy monetization strategy and its emerging role as a blueprint for others[42].

https://www.trade.gov/country-commercial-guides/ethiopia-energy

[2] [4] [5] [9] [10] [12] [13] [19] [21] [24] [25] [32] [36] [38] [40] [41] [42] [43] [44] [46] [47] 18% of Ethiopia’s Electricity Revenue Now Comes from Bitcoin Mining: A New Era for BTC and the Global Grid – CoinReporter

[3] [14] [15] [16] [37] Ethiopia accounts for 2.5 percent of Bitcoin mining hashrate

https://laraontheblock.com/ethiopia-accounts-for-2-5-percent-of-bitcoin-mining-hashrate/

[6] [11] [17] [20] [48] Bitcoin Mining Powers Ethiopia’s $55M Surplus Energy Revenue: Report

https://ethiopiantribune.com/2025/06/ethiopias-bitcoin-mining

[18] [30] [31] [39] Ethiopia Signs On: 600MW Of Energy To Supercharge Bitcoin Mining

https://bitcoinist.com/ethiopia-signs-on-600mw-of-energy-to-supercharge-bitcoin-mining/

© Africa Climate and Energy Nexus. All Rights Reserved

2025